TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the docket today… Staplegate comes to a stirring conclusion, Trump tried to fire J-Poww (I think?), and Sam Altman wants to turn on the money printer. But first...

In the July 16, 2018 edition of The Water Coolest, we covered Lloyd Blankfein officially introducing David Solomon as CEO during Goldman’s earnings calls. Of course, it wasn’t entirely a surprise, with the glow-stick toting exec ascending to heir apparent status (read: updating his LinkedIn to President of GS) earlier in ‘18.

His tenure hasn’t been all earnings beats and protected Saturdays, though. He inherited the 1MDB sh*tshow, was dragged publicly for his DJ set in the Hamptons alongside the Chainsmokers (while the rest of us were balls deep in lockdown), and damn near got run out of 200 West after his bet on consumer banking went sideways.

But D-Sol must be doing something right. Goldman awarded him a (controversial) $80M retention package earlier this year. Nice work if you can get it.

Enjoy the next 4 minutes and 42 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who is still holding GME. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who knows you’re still bagholding GME) forward this to you? Subscribe here.

Bold strategy, Cohen

When it’s all said and done, the “Greatest Accomplishments as CEO of GameStop” section on Ryan Cohen’s Wikipedia page is going to have a single entry: “Staplegate.”

The man who promised mouthbreathers and crayon eaters that he’d transform GameStop $GME ( ▼ 1.18% ) into an Amazon competitor will be remembered for… making $250k on a charity auction.

Story time…

The corner of the internet that’s as lonely as it is in need of deodorant (read: gamers) lost its collective mind after some GameStop employee punctured a Switch 2 screen when stapling a receipt to the front of the box. For those of you who have felt the tender embrace of the opposite sex (or the same sex… who am I to judge?), this was a BFD given the new Switch 2 was in short supply at launch.

Welp, GameStop saw an opportunity to make headlines (and some money for charity). It auctioned off the console, staple, and the most famous stapler since Milton’s Swingline for a quarter of a million dollars.

The good news is that a charity made some money. The bad news is that GameStop might need to start a GoFundMe if it doesn’t get its sh*t together soon…

So, what is the turnaround plan for GME?

It’s still not entirely clear.

But we do know one thing that it’s not going to be… a Microstrategy Strategy dupe. Despite announcing it had bought 4.7k bitcoins in May, Cohen said earlier this week he’s got no intention to become a sh*tcoin HODLco a la Michael Saylor.

“Best I can do is trading cards and collectibles…” - RC

The CEO who tweets things like “Jack, I want you to draw me like one of your French girls,” is leaning into Pokémon and baseball cards in a big way. 1998 called and it wants its strategic initiative back…

Cut costs, not talent

In today’s economy, every dollar counts, but that doesn’t mean you have to compromise on quality. Upwork connects you with top freelance professionals across industries like AI, design, software, and marketing, without the overhead. Whether you need a quick deliverable or a full-scale project, Upwork helps you hire on your terms.

So why do thousands of smart business owners choose Upwork?

Top-tier talent, minus the full-time cost

Transparent pricing with no cost to join and no cost until you hire

Over 10,000+ skills available, from niche experts to generalists

AI-powered matching tools that help you find the right pro, fast

Work samples, client reviews, and verified profiles for full confidence

Flexible contracts that allow you to hire hourly or per project

Hiring has never been this efficient. Post a job in minutes. Review vetted candidates. Approve work and pay only for what you love.

Whether you're scaling quickly, navigating tight budgets, or launching something new, Upwork is your secret weapon for getting more done, without overextending your team.

+ According to an anonymous source at the White House, POTUS told a room of lawmakers he was ready to fire Mr. Too Late (read: J-Poww). And I think we can all agree it was Barron home on summer break, right?

Later in the day, DJT cleared up the rumors, hitting us with the political equivalent of ‘sike’… ‘but I definitely could if I wanted to.’

POTUS clarified, “We’re not planning on doing it,” but went on to add, “I don’t rule out anything, but I think it’s highly unlikely, unless he has to leave for fraud.” ‘Fraud,’ like, say… being irresponsible with $2.5B of taxpayer money for a Fed HQ buildout…?

+ Ok, now add back the cocaine…

According to the President, Coca-Cola $KO ( ▲ 1.91% ) has agreed to use real cane sugar instead of corn syrup in the US from here on out. Does this mean that one friend everyone has will stop saying stuff like “Mexican Coke is elite because of the cane sugar.”

+ A few more quarters like this and the board is going to sign off on DJ D-Sol spinning at Coachella and resuming recreational ketamine use…

Goldman $GS ( ▼ 0.42% ) just put analysts’ top and bottom line estimates in a body bag. Not unlike JPM and Citi, the bank with the most famous elevator on the Street benefitted from yuge trading and advsiroy windfalls.

Despite the headwinds that helped even the financial institution

+ Sam Altman is ready to make the money printer go brrr.

According to the FT, OpenAI is building tech that’ll allow it to earn a commission every time an e-comm sale is made on the platform. Rumor has it OpenAI is partnering with Shopify on the integration, hence SHOP shares popping yesterday.

+ Who’s going to tell Peter Thiel he can just buy ETH directly?

Shares of Bitmine Immersion Technologies $BMNR ( ▼ 6.47% ) mooned as much as 29% on news that Peter Thiel’s Founders Fund took a 9% stake in the company that’s buying ETH like a college freshman who just got access to his Bar Mitzvah money…

+ GrabAGun: great at ticker symbols… bad at market debuts.

Brutal day for your uncle with the Ted Nungent poster on his beer fridge in the garage. “The Amazon of Guns” fell more than 20% in its stock market debut. To be fair, it was via SPAC.

The company made headlines when it announced Don Jr. had joined its board. He was on hand to ring the opening bell yesterday morning (obviously).

Is Your Wallet Ready for the One Big Beautiful Bill?

Are you ready for what the One Big Beautiful Bill means for your taxes? Of course, you aren’t. Whose got time to read bills? (spoiler: the team at Gelt does).

If you’re scaling a business past $150K, your tax bill is about to get more complicated—and more important. It’s not just about what you earn, but what you keep. Gelt is the expert team built for navigating complexity and keeping more in your pocket.

How Gelt helps:

Strategic planning to reduce future tax liability

Ongoing guidance as you grow

White-glove filing by expert CPAs

One platform to manage it all

Year-round access to a real team

Big changes are coming in 2025. Don’t wait to get ahead.

Gelt is giving 10% off year 1 for TWC readers. Book your free assessment now

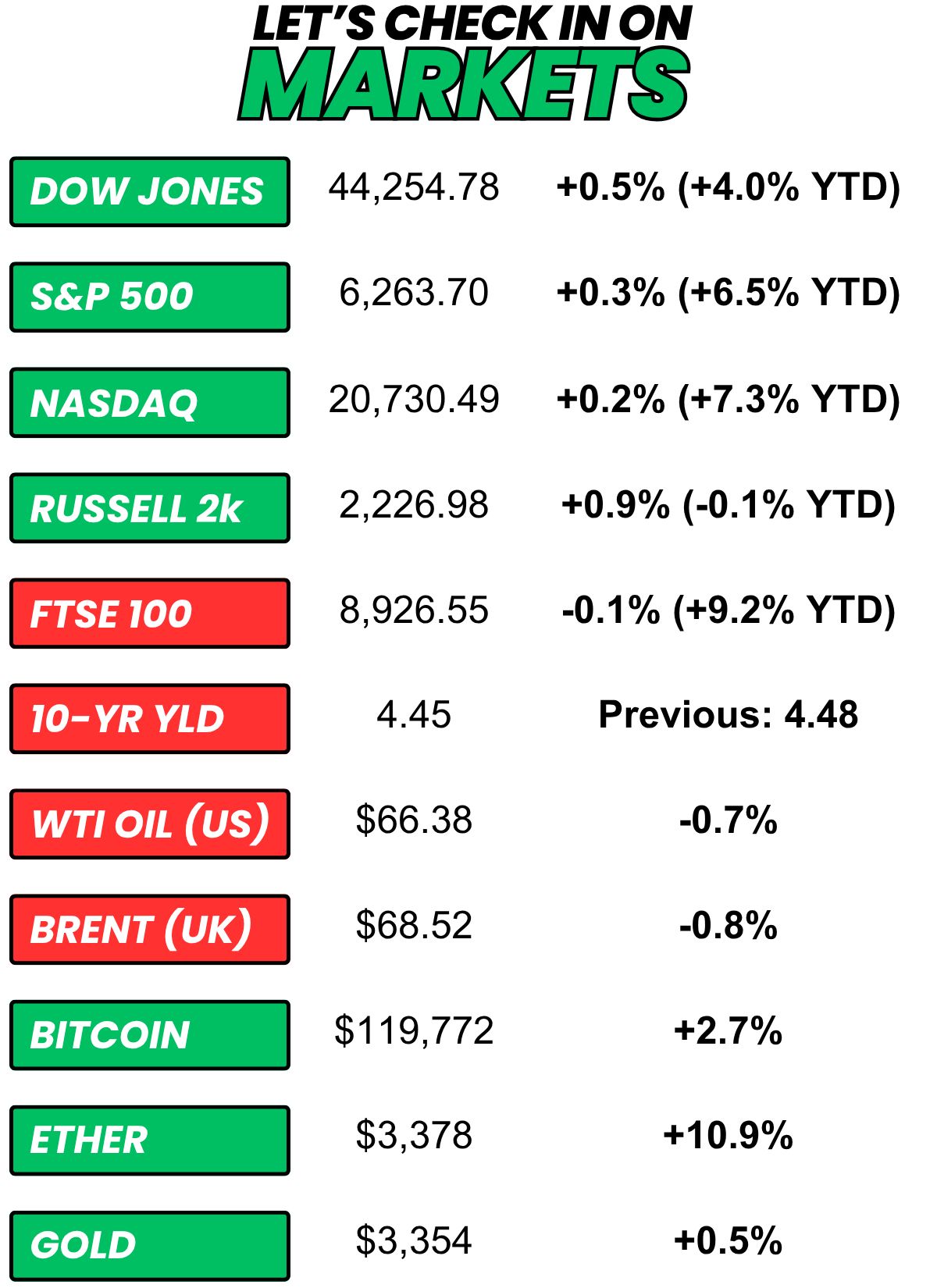

+ US stocks “recovered from session lows to end Wednesday's trading session higher after President Trump said he's "not planning" to fire Fed Chair Jerome Powell, taking the air out of new reports emerging suggesting he was close to making that decision.” (Yahoo! Finance)

+ The 10-year yield “fell on Wednesday as traders weighed the possibility that President Donald Trump could fire Federal Reserve Chair Jerome Powell.” (CNBC)

+ Oil “settled marginally lower on Wednesday as U.S. fuel inventory builds and concerns about wider economic impact from U.S. tariffs outweighed some signs of increasing demand.” (Reuters)

+ The “smart” money thinks there’s a 33% chance Happy Gilmore 2’s Rotten Tomatoes score will crack 60. (Kalshi)

⏪ Yesterday…

+ ASML, Johnson & Johnson, Goldman Sachs, Bank of America, Morgan Stanley, Progressive, and Prologis reported before the bell

+ United Airlines, Discover Financial Services, and Kinder Morgan reported after hours

+ The Producer Price Index report for June dropped

+ The Federal Reserve released its Beige Book Report

⏩ Today we’re keeping an eye on…

+ Taiwan Semiconductor, Pepsi, GE Aerospace, Abbott Labs, Cintas, Elevance Health, US Bancorp, and The Travelers Companies report before the bell

+ Netflix and Interactive Brokers Group report after the bell

+ It is the 70th anniversary of the Disneyland Resort Cali

+ We’ll get the June Retail Sales report

Yesterday, I asked, “You're interviewing with a CEO. Which of the following would be the biggest red flag?”

41.6% of you said “We don't call them employees, they're family.“

Here’s what some of you guys had to say…

Other: "We are a fast paced, dynamic, and ever evolving org..." means they don't have their sh*t together.”

“I wake up at 4 am and meditate for 90 mins”: “Okay hardo! Plus, I think you're full of sh*t.”

Other: “I disclosed my wife was going to deliver our baby in a few weeks - CEO said "Maybe she could take a taxi to the hospital".”

“We don't call them employees, they're family.“: “Yeah right! Family won't smile in your face 30 seconds ago then cuss you out over some meaningless bs....wait actually they will do just that!”

“Our org chart is flat”: “flat org chart just means I'm going to be everyone's b*tch”

Here’s today’s question…

You can only keep one Coke. The rest go away. Which one are you saving?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.