TOGETHER WITH

Hey there weekday warrior,

Today, we’re getting into big bank earnings, CPI data, and Google’s newest capex. But first...

In the July 16, 2024 edition of The Water Coolest, we talked about Burberry getting absolutely buried.

Shares of the luxury maker fell nearly 20% on the day. And, believe it or not, it had nothing to do with people realizing that Burberry’s entire market cap hinges on the popularity of one stupid f*cking plaid pattern…

It warned of an operating loss for the first half of the year… and axed the guy responsible (CEO Jonathan Akeroyd was “made redundant”). Oh, and the company killed its dividend.

Just a year later, new Joshua Schulman has put the team on his back. Shares have jumped more than 67% following deep cost-cutting (read: layoffs) and refocusing on its core outerwear products.

Enjoy the next 4 minutes and 30 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who has been talking about MP Materials for years. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who knows you can’t get enough of MP Materials) forward this to you? Subscribe here.

Monitoring the situation

For a guy who has predicted 17 of the last 3 global economic meltdowns, Jamie Dimon sure had some nice things to say about the US economy…

During JPMorgan’s $JPM ( ▲ 1.43% ) earnings call, Dimon admitted (reluctantly), “The U.S. economy remained resilient in the quarter” (thanks to “the finalization of tax reform and potential deregulation”).

Not that he had a choice. Ball (and the numbers) don’t lie…

The biggest bank in the US put on a clinic, beating on the top and bottom lines. JPM’s trading and investment bank divisions had yuge quarters… presumably because everyone was working in the office and JPMorgan clients didn’t have any exposure to bitcoin.

(And it wasn’t just JPMorgan… Citi and Wells Fargo beat the Street’s estimates, too.)

Oh, and the bank eased up on its provision for credit losses (from $3.4B to $2.8B), further eroding Jamie Downer’s narrative that “the end is near.”

Of course, that doesn’t mean the only dude on the Street more bearish than Michael Burry didn’t remind us that he’s monitoring the (deteriorating) situation…

Buzz Killington went on to add that “significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices.”

And even though we didn’t ask, we also got Jamie’s thoughts on the Fed’s independence. Jamie made it clear that he has a major man-crush on J-Poww (same, Jamie, same): “The independence of the Fed is absolutely critical, and not just for the current Fed chairman, who I respect, but for the next Fed chairman.”

Use summer to slow down and check in with yourself

Summer can offer a much-needed pause. If you're feeling disconnected, therapy is a powerful way to reflect and reset. With BetterHelp, you can talk to a licensed therapist from anywhere—even poolside or between flights.

BetterHelp makes it easy to connect with a therapist who understands burnout and high-pressure environments. You can talk through what’s weighing on you, on your schedule, from anywhere.

72% of clients report feeling better within 12 weeks, and sessions are rated 4.9/5 based on 1.7 million reviews. For a limited time, new users get 25% off the first month.

+ “Consumer Prices LOW. Bring down the Fed Rate, NOW!!!” - Lil Wayne on ‘The Carter’ Donny Politics on TRUTH Social

POTUS has got bars, you guys (I think we all already know his album cover would go pretty damn hard). So, why was DJT spitting rhymes about cutting rates on his social media platform?

Because prices (*double checks notes*) jumped in June…

The Consumer Price Index rose 0.3% last month, meaning inflation hit 2.7% annually. When you remove food and energy (think: core CPI) it jumped 0.2% in June and is up 2.9% on the year.

Both the core and the missionary varieties were in line with the Street’s expectations, but still showed the kinda uptick that will have J-Poww staying higher for longer.

+ The ‘Erin Brockovich 2’ script is writing itself…

Big tech continues to mainline resources (power and water) directly into its AI infrastructure projects without regard for human life.

A day after Meta $META ( ▼ 0.21% ) announced “hundreds of billions of dollars” of AI infrastructure spend (and the NYT blamed Zuck for taps running dry next door to Meta’s current AI factory), Google $GOOGL ( ▲ 0.33% ) went all “Meta, I see your ‘hundreds of billions’, and raise you $25B.”

The company that just ran train on Windsurf’s c-suite is planning to invest $25B in data center and AI infrastructure. And in a bid to “don’t be evil,” Google is also plowing $3B into hydropower modernization in Pennsylvania. Whatever helps you sleep at night, Sundar…

+ “You come for the king, you best not miss.” - Michael Bloomberg to Anthropic

Claude has set its eye on financial services by way of its Claude for Financial Services offering (super original name, you guys).

Product lead Jonathan Pelosi (no relation to the greatest traders of the 21st century) said Claude-for-dudes-named-Chad will be beefed up to handle huge loads (of financial data) and play nice with Box, Daloopa, Databricks, Morningstar, Palantir, Pitchbook, S&P Global, and Snowflake.

+ The perfect stock ticker doesn’t exi—

GrabAGun (which is exactly what you think it is) will begin trading today under the ticker symbol PEW following a SPAC merger. *chef’s kiss*

+ Nobody, and I mean nobody, is having a better week than MP Materials $MP ( ▲ 2.92% ), the only miner of rare earth materials in the US. First, the Pentagon took a $400M stake in the company.

Then, yesterday, Apple $AAPL ( ▼ 0.07% ) signed a $500M deal with MP to buy rare earth magnets and will collaborate on building a rare earth recycling facility. And Tim Cook will really do anything to avoid making Apple’s AI functional, won’t he?

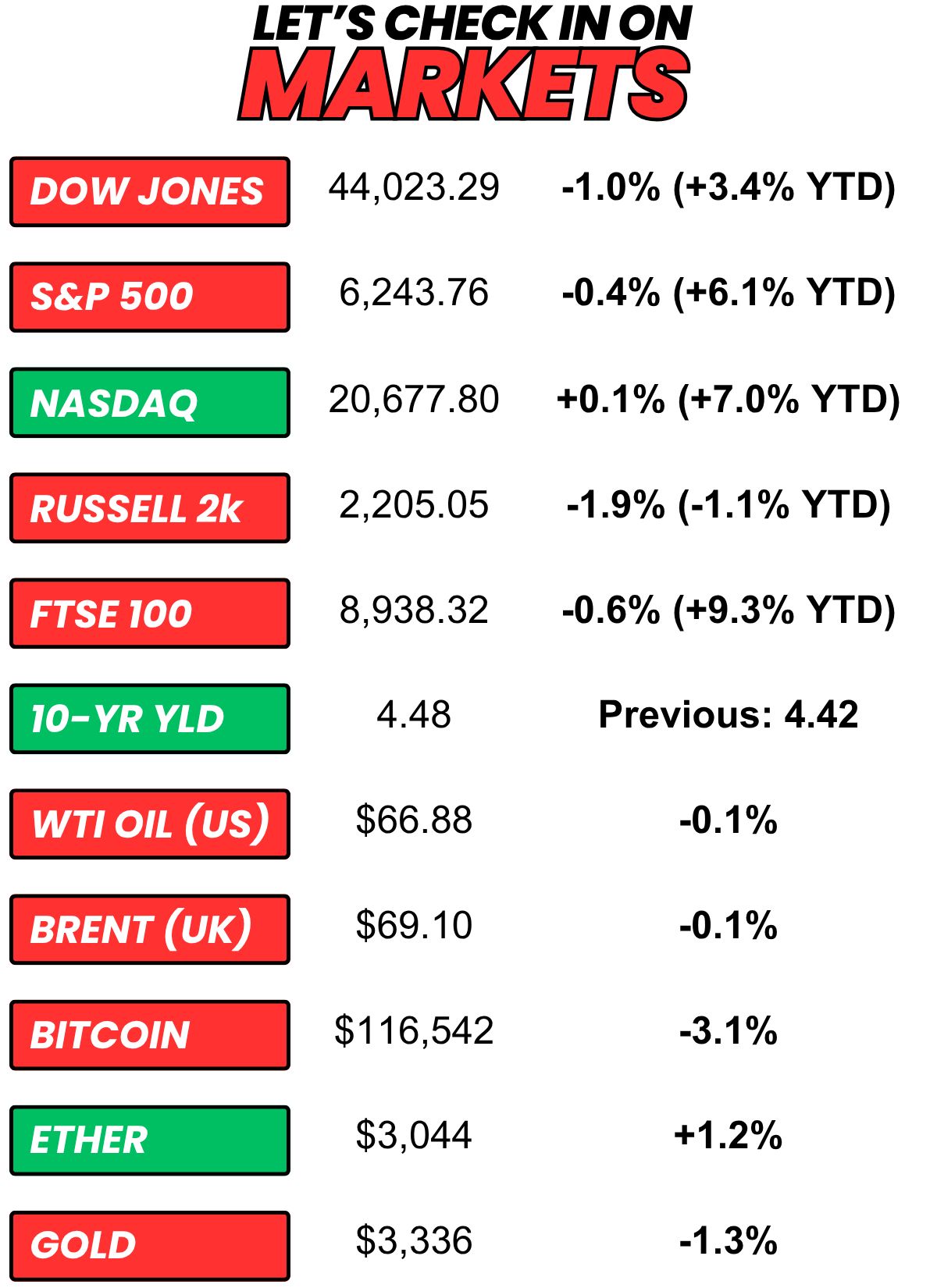

+ US stocks “closed mixed Tuesday as a key consumer inflation print showed inflation accelerated in June, big banks kicked off earnings season, and Nvidia (NVDA) looked set to receive a green light for trade with China from the Trump administration.” (Yahoo! Finance)

+ The 10-year yield “rose Tuesday as traders assessed the latest U.S. inflation report and what it means for Federal Reserve monetary policy going forward.” (CNBC)

+ Oil “slipped lower Tuesday, continuing the previous session’s selloff after U.S. President Donald Trump provided Russia with additional room to end the Ukraine war before taking action.” (Reuters)

+ Bitcoin “fell below the $117,000 level on Tuesday after cryptocurrency-related bills were blocked in the House of Representatives.” (CNBC)

+ The “smart” money thinks there’s a 48% chance additional Epstein files will be released in 2025. (Polymarket)

⏪ Yesterday…

+ JPMorgan Chase, BlackRock, Citigroup, Wells Fargo, and The Bank of New York Mellon Corp reported before the open

+ The Consumer Price Index report for June dropped

+ Tesla opened its first official store in India

⏩ Today we’re keeping an eye on…

+ ASML, Johnson & Johnson, Goldman Sachs, Bank of America, Morgan Stanley, Progressive, and Prologis report before the bell

+ United Airlines, Discover Financial Services, and Kinder Morgan report after hours

+ The Producer Price Index report for June will drop

+ The Federal Reserve will release its Beige Book Report

Yesterday, I asked, “Do you return a shopping cart to the designated cart return or are you a heathen?”

91.1% of you “Return it to cart return area.“

Here’s what some of you guys had to say…

I just leave it wherever I damn well please: “Unashamed virtue signal - I ALWAYS grab some old lady's cart when she unloads and take it in to shop - so I have earned the right to dump one wherever I wish”

Return it to cart return area: “Based on my previous work experience as a Safeway cart guy, I feel like your readers are lying. 90% my ass, 70% at best”

Return it to cart return area: “Society works because of the unspoken rule that you carry your own weight when you can. This is such a low bar to cover in achieving that. ”

Here’s today’s question…

You're interviewing with a CEO. Which of the following would be the biggest red flag?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.