Hey there weekday warrior,

Today, we’re getting Google putting OpenAI in a body bag, Kraft and Heinz on the way to splitsville, and more tariffs (obviously). But first...

In the July 14, 2022 edition of The Water Coolest, we got into the fake CPI report floating around Twitter (and the real one).

A day ahead of the much-anticipated CPI drop (friendly reminder: the economy was spiraling in spring and summer of 2022), a fake report began circulating online that showed a whopping 10.1% increase in prices. Markets cratered on the news.

But the Bureau of Labor Statistics was quick to call bullsh*t…

We’re aware of a fake CPI release image circulating on Twitter. It is a fake. Stay tuned for the real CPI release tomorrow at 8:30 AM ET.

— #BLS-Labor Statistics (#@BLS_gov)

9:07 PM • Jul 12, 2022

Unfortunately, the real CPI data that dropped the next day was still pretty brutal (9.1%). That was above analysts’ expectations (and incredibly alarming).

Enjoy the next 4 minutes and 26 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who will leave a restaurant if it’s anything but Heinz ketchup on the table. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who knows your ketchup preferences) forward this to you? Subscribe here.

One man’s trash…

Holy air ball, Zuck…

Sundar Pichai has still got it, you guys. The Google $GOOG ( ▲ 0.37% ) CEO just went full Mr. Steal Your Girl (ok, well, technically they’re dudes) on Sam Altman.

Story time…

You might recall that earlier this year, OpenAI entered into exclusive talks to buy Windsurf for $3B. But rumor has it that OpenAI wasn’t playing nice in the sandbox and didn’t want to share the AI coding assistant with Microsoft, which owns a huge chunk of the ChatGPT maker.

While the internal negotiations dragged on, it appears someone got cold feet. Because the deal officially fell apart Friday, and the vultures (sup, Google) wasted no time swooping in.

But Google didn’t want all of Windsurf… it picked at the proverbial carcass.

Instead of ponying up $3B+, Google DeepMind is simply hiring Windsurf CEO Varun Mohan, co-founder Douglas Chen, and a bunch of other talent that’s about to get a Zuck-sized bag of unmarked bills.

Alphabet won’t even take a stake in the company. But they are entering into a $2.4B non-exclusive licensing deal with them. So, in theory, OpenAI could get out of the c*ck chair and back into the scrum.

The structure makes sense for Google. Not only does it get a bunch of talent on its roster, but by not buying outright (or even taking a stake), it avoids the prying eyes of those pesky regulators in DC.

It might sound crazy, but there's a much easier way to pay down debt faster…

Spoiler: using a credit card.

Here’s EXACTLY how to do it…

Find a card with a “0% intro APR" period for balance transfers

Transfer your debt balance

Pay it down as much as possible during the intro period

No interest means you could pay off the debt faster.

Now it’s time to find the right card…

Some of the top credit card experts identified one of their favorites that puts interest on ice until nearly 2027 AND offers up to 5% cash back on qualifying purchases.

+ Ok, but who gets the kids crippling debt load in the divorce?

Just a day after Ferrero took out WK Kellogg, there is another massive shakeup looming in the packaged food space.

Rumor has it that Kraft Heinz $KHC ( ▲ 1.7% ) is considering splitting up. It makes sense considering shares are down by more than 60% since Warren Buffett orchestrated a combination of Kraft and Heinz. In his defense, merging the company behind Oscar Mayer (Kraft) and the company that owns the ketchup, mustard, and relish market (Heinz) makes a lot of sense…

It’s not entirely clear how the company would be broken up, but it would likely spin off some of its less profitable grocery staples, so it can focus on its ketchup and sauces biz.

+ “Hey Siri, how do we make investors forget we’re falling behind in AI?” - Tim Cook

After paying entirely too much attention to making a hit Brad Pitt F1 movie instead of advancing its Apple Intelligence capabilities… Apple $AAPL ( ▲ 0.5% ) is paying entirely too much attention to winning F1 broadcast rights. We get it, Tim, you watch Drive to Survive.

AAPL is willing to pay $150M per year for F1 rights. Although that’s a boatload more than ESPN currently pays, it’s the low end of what Liberty Media is seeking (between $150M and $180M). The Worldwide Leader did say it plans to make a bid, which F1 may prefer since everyone cancels AppleTV as soon as ‘Severance’ is over…

+ Like a Little League Coach making sure everyone gets an at-bat (except the at-bat is paying fat taxes to Uncle Sam), President Trump continued his tariff rollout over the weekend…

This time, he got two of our biggest trade partners some playing time. Donny Duties threatened 30% tariffs on Mexico and the EU over the weekend. Although in the letters he sent/posted to Truth Social, #47 promised to work towards a deal.

+ “This is why we can’t have nice things…” - Jerome Powell

God forbid a Fed chair spend $2.5B updating the Central Bank’s HQ. The Trump administration lodged a complaint with the President’s budget director, related to the Federal Reserve’s Extreme Makeover: Home Edition. The accusation? That he lied or mismanaged the build-out.

Of course, this could be (read: is definitely) Trump’s attempt to apply pressure on “Mr. Too Late” (Jerome Powell) to lower rates.

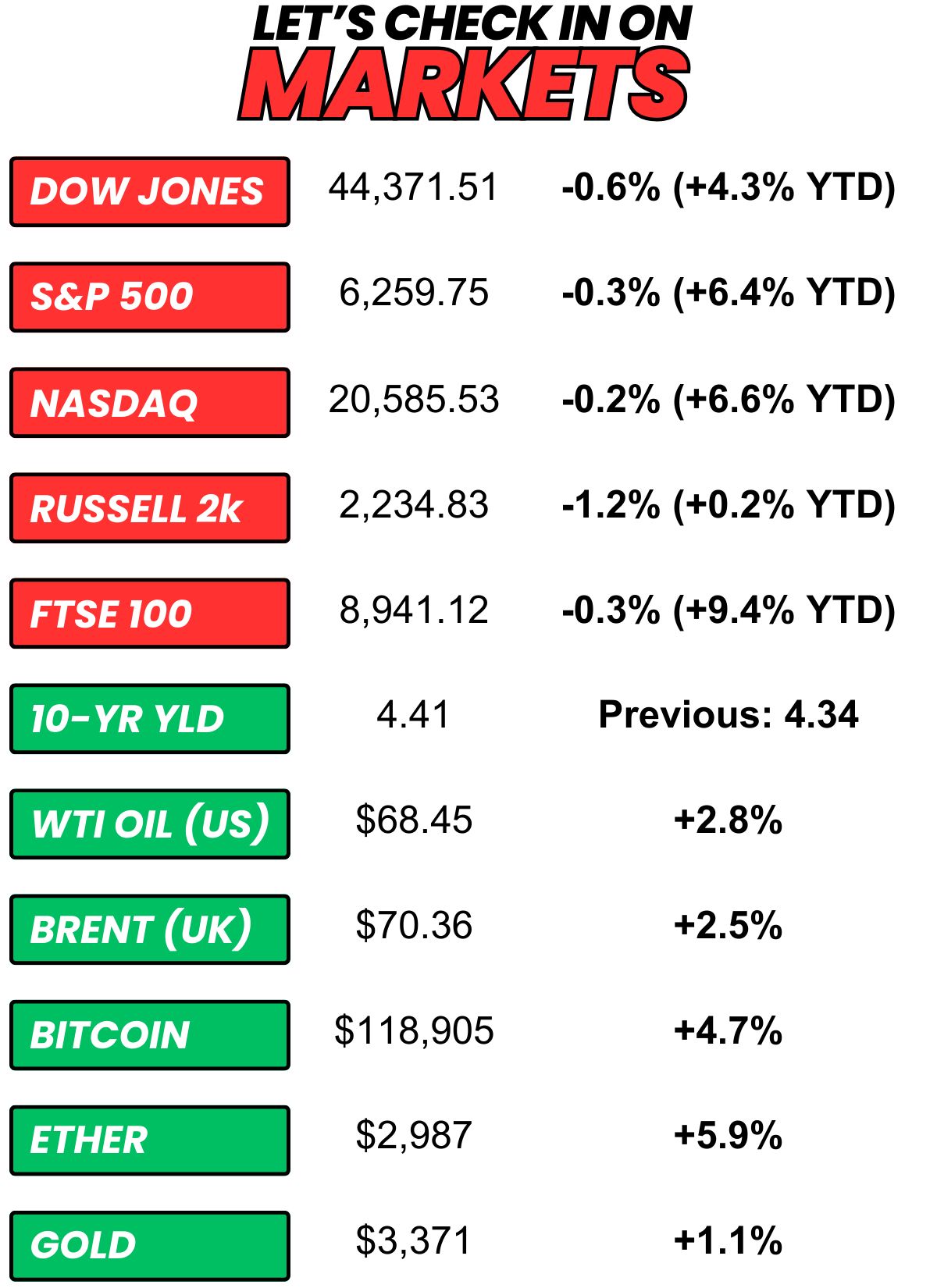

+ US stocks “closed lower Friday, a day after the S&P 500 posted a new record high and President Donald Trump announced a 35% tariff on Canada and threatened higher tariffs across the board.” (CNBC)

+ The 10-year yield “moved higher on Friday as President Donald Trump slapped 35% tariffs on Canada and investors digested a week of trade drama.” (CNBC)

+ Oil “rose over 2% on Friday as the International Energy Agency said the market was tighter than it appears, while U.S. tariffs and possible further sanctions on Russia were also in focus.” (Reuters)

+ The “smart” money thinks there’s a 42% chance CPI increases by more than 0.2% in June 2025. (Kalshi)

⏪ Yesterday…

+ The US Treasury Department released a monthly account of the surplus or deficit of the federal government

⏩ Today we’re keeping an eye on…

+ Fastenal reports before the bell

Friday, I asked, “Who is the TWC Dumba** of the Week?”

Half of Gen Z who thinks saving for the future is pointless (and it wasn’t even close)

Grok for being antisemitic af

Goldman CEO David Solomon asking for blood oaths from analysts

Here’s today’s question…

getting in the waymo after 3 drinks and asking the waymo how long its been waymoing

— #Kendall Pennington (#@Kenny___Rose)

2:50 AM • Jul 12, 2025

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.