TOGETHER WITH

Hey there weekday warrior,

Today, we’re getting into Elon vs. a Wall Street analyst, Robinhood defending its “equity tokens,” and a bunch of Zuck news. But first...

In the July 9, 2024 edition of The Water Coolest, we talked about David Ellison/Skydance sealing the $8B deal for Paramount after months of drama.

“Oh, so the drama is over now that the ink has dried, right?” - you, probably

LOL.

A year later, the deal isn’t even remotely close to being finalized. The agreement has already auto-renewed twice (most recently, yesterday). The roadblock? Regulators at the FCC are holding up the deal, thanks to the Chair’s concerns about DEI and CBS news coverage (see: that Kamala 60 Minutes interview).

Enjoy the next 4 minutes and 34 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who thinks Wendy’s is the best burger chain in the game. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who knows you love Wendy’s) forward this to you? Subscribe here.

STFU

Jeff Skilling walked so Elon could run…

Friendly reminder: the former Enron CEO famously called an analyst an a**hole during an earnings call when asked why the company couldn’t produce a balance sheet (spoiler alert: it was because of all the crime).

Thanks to advancements in Al Gore’s internet and Jack Dorsey’s invention of Twitter, Elon is able to belittle analysts in real time. And for that, we will be forever grateful.

Elon told (Tesla bull) Dan Ives, who looks like a Margaritaville manager every time he appears on CNBC, to “Shut up” following his criticism of Elon’s new political ambitions (see: forming the America party)…

Tesla Board of Directions...take the following 3 steps in our view

1. New pay package getting Musk to 25% voting control. Clears a path for xAI merger.

2. Guardrails established for amount of time Musk spends at Tesla as part of pay package

3. Oversight on political endeavors 🎯— #Dan Ives (#@DivesTech)

10:53 AM • Jul 8, 2025

The second-biggest Tesla bull (sup, Cathie Wood), threw more shade in an analyst note titled: “The Tesla board MUST Act and Create Ground Rules For Musk; Soap Opera Must End.”

Friendly reminder: the note comes just a day after Elon’s latest decision wiped out $68B in market cap.

You might recall that rumors were swirling a few weeks back that the Tesla board had lost faith in Elon given his public pissing match with POTUS…

I promise not to call the fashion police on Dan if he claps back by saying Elon was on Epstein’s client list…

Keep Your SSN Off The Dark Web

Every day, data brokers profit from your sensitive info—phone number, DOB, SSN—selling it to the highest bidder.

What happens then?

Best case: companies target you with ads.

Worst case: scammers and identity thieves breach those brokers, leaving your data vulnerable or on the dark web.

It's time you check out Incogni. It scrubs your personal data from the web, confronting the world’s data brokers on your behalf. And unlike other services, Incogni helps remove your sensitive information from all broker types, including those tricky People Search Sites.

Help protect yourself from identity theft, spam calls, and health insurers raising your rates. Plus, just for Water Coolest readers: Get 55% off Incogni using code TWCDEAL.

+ Just me, or does Vlad Tenev have a bad habit of downplaying things that are, indeed, a big f*cking deal?

Exhibit A: In early 2021, the Robinhood $HOOD ( ▲ 3.73% ) CEO effectively put an end to the memestonk madness by halting the ability to buy shares of heavily shorted tickers on his platform (sup GameStop & AMC)… but allowed selling.

He said it had nothing to do with his ties to Ken Griffin and other market makers who didn’t want to sit around and watch their fellow hedge fund fat cats get blown up (RIP Melvin Capital) and everything to do with “meeting federal clearinghouse requirements.”

Exhibit B: after OpenAI called bullsh*t on that “tokenized OpenAI equity” HOOD is peddling, the brokerage CEO said, “so what?” Vlad told CNBC that “In and of itself, I don’t think it’s entirely relevant that it’s not technically an equity instrument.”

Robinhood claims it’s kosher given that the “equity” is “enabled by Robinhood’s ownership stake in a special purpose vehicle.”

+ Zuck out here getting his Pat-Riley-2010-offseason (see: assembling the Big 3) on. His latest addition to the Meta $META ( ▼ 1.05% ) Superintelligence Lab? Apple’s top AI expert, Ruoming Pang. His pay package will reportedly be in the tens of millions of dollars.

I’ll just leave this right here…

this is who is coming after your engineers bro

— #alli (#@sonofalli)

10:37 PM • Jul 4, 2025

+ “Might f*ck around and put 50% tariffs on copper.” - President Trump

Donny Duties woke up and chose violence on Tuesday. He announced tariffs on copper and pharmaceuticals… I think. DJT said, “I believe the tariff on copper, we’re going to make it 50%.” But that wasn’t the only tariff he appeared to make up on the spot. He also plans to tax pharmaceuticals “at a very, very high rate, like 200%.”

And you’re never going to guess what happened to copper prices next (see: new all-time high).

+ AI and sunglasses. That’s what Meta does.

Artificial intelligence talent isn’t the only thing Zuck is blowing money fast on. He’s also set aside some budget for sunglasses. To be fair, it’s a better use of money than the metaverse. The company formerly known as Facebook just took a 3% stake in EssilorLuxottica.

You might recall that Meta partners with EL on Ray-Ban smart glasses and is planning to

+ “Yeah, so that’s why they call it Government Sachs.” - some finance intern to a marketing intern at the Spaindard tonight after explaining why it’s a big deal that Goldman $GS ( ▲ 0.9% ) is hiring former British PM Rishi Sunak as a senior advisor.

+ And the Ozempic Lifetime Achievement award goes to… Kirk Tanner. This dude has done more for obesity than Lizzo. After more than three decades at Pepsi, Kirk took his talents to Wendy’s last year. And yesterday, he was named CEO of Hershey. A truly legendary run.

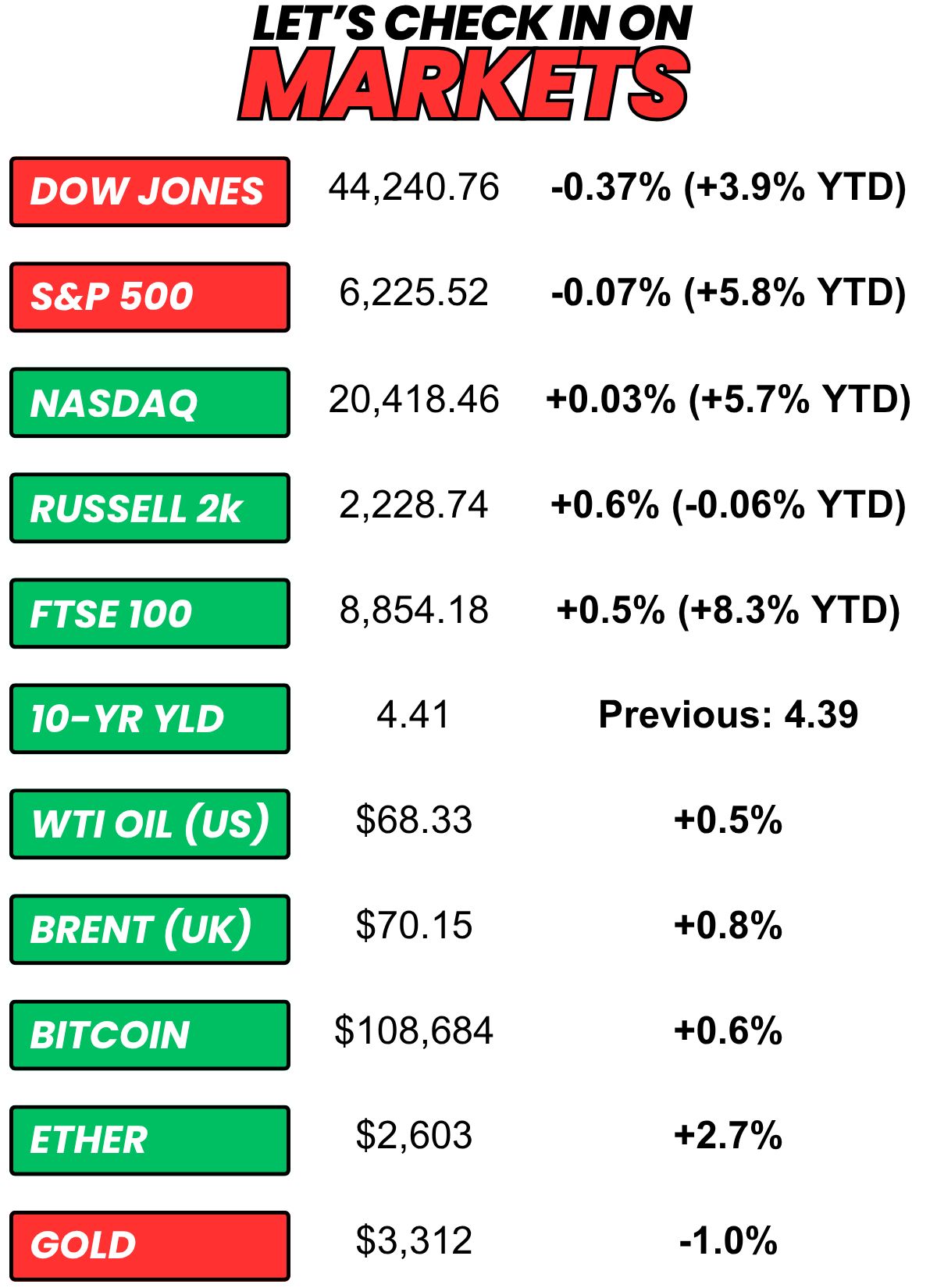

+ US stocks “were mixed as China lashed out at US president Donald Trump's latest tariff moves.” (Yahoo! Finance)

+ The 10-year yields “were little changed on Tuesday as investors continue to assess the aftermath of President Donald Trump's tariff letters threatening steep duties on several countries, including key allies.” (CNBC)

+ Oil “edged up to a two-week high on Tuesday on forecasts for less U.S. oil production, renewed Houthi attacks on shipping in the Red Sea, worries about U.S. tariffs on copper and technical short covering.” (Reuters)

⏪ Yesterday…

+ The four-day Amazon Prime Day event began…

⏩ Today we’re keeping an eye on…

+ Samsung will hold its Galaxy Unpacked event

+ Tyson Foods will hold its annual Tyson Foods Demo Day event in Springdale, Arkansas. Think John R. Tyson is allowed at post-demo day happy hour?

+ The Federal Reserve will release the minutes from its last meeting.

Here’s today’s question…

In honor of Kirk Tanner’s…

You can get one totally free (unlimited) for the rest of your life. You can't consume the others. Which are you taking?

BREAKING: Scott Bessent announces trade deal with the Epstein Island

— #The Maverick of Wall Street (#@TheMaverickWS)

2:32 PM • Jul 8, 2025

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.