Hey there weekday warrior,

Today, we’re getting into Nike overpromising, Jeff Bezos and Lauren Sánchez tying the knot, and inflation rearing its ugly head. But first...

In the June 30, 2020 edition of The Water Coolest, we talked about that time Lululemon tried to get its Peloton on (and regretted it pretty much immediately)…

At the height of the at-home fitness boom, Lululemon bought Mirror for $500M. Mirror was a (you guessed it) smart mirror that allows users (who don’t want to just use their TV) to attend live yoga and Pilates classes.

Turns out, Lululemon should’ve stuck to see-through yoga pants and khakis for middle management. The market for at-home fitness hardware dried up quicker than PPE sales on Etsy not long after the deal. LULU ended up writing off the acquisition and stopped selling the Mirror altogether. To bring things full circle, they ended up inking a fitness partnership with Peloton.

Enjoy the next 4 minutes and 26 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who also didn’t get invited to Bezos’ wedding. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who feels bad you didn’t make the guest list for the Bezos-Sanchez nuptials) forward this to you? Subscribe here.

Trust me, bro

Gif by IndianaJones on Giphy

That sound you hear is Wall Street and retail investors giving Nike CEO Elliott Hill a Gluck Gluck 9000.

Shares of the Swoosh popped 17% on Friday despite a quarter that was more Under Armour than Nike $NKE ( ▲ 0.15% ).

Why?

Well, mostly because the man whose legacy (and equity compensation) depends on sticking the landing of a turnaround hit investors with “trust me, bro.”

Sure, sales dropped 12% in the most recent quarter, but CEO Elliott Hill is convinced the biggest financial hit from the turnaround is behind NKE. And this dude’s rizz is so far off the charts that he was able to convince the Street that even tariffs couldn’t derail the comeback (friendly reminder: most of Nike’s shoes and apparel are made by children in China and Vietnam).

During the company’s earnings call, Hill shared details on how he plans to Make Nike Great Again/make HOKA his b*tch…

New look Nike is partnering with everyone with an IG account and two X chromosomes. It’s making a big push with the ladies, a demo with which it has historically struggled. See: Nike x Skims (think: Kim K’s shapewear brand) and a new A’ja Wilson collection.

Oh, and it’s reversing course on that direct-to-consumer pivot, which went about as well as Nike signing Colin Kaepernick that one time. Step one: limp back to Amazon with its tail between its legs and beg Andy Jassy for mercy (and by ‘mercy’ I mean access to hundreds of millions of dollars).

Are you ready for what the One Big Beautiful Bill means for your taxes?

Of course, you aren’t. Whose got time to read bills? (spoiler: the team at Gelt does).

If you’re scaling a business past $150K, your tax bill is about to get more complicated—and more important. It’s not just about what you earn, but what you keep. Gelt is the expert team built for navigating complexity and keeping more in your pocket.

How Gelt helps:

Strategic planning to reduce future tax liability

Ongoing guidance as you grow

White-glove filing by expert CPAs

One platform to manage it all

Year-round access to a real team

Big changes are coming in 2025. Don’t wait to get ahead.

Right now, TWC readers can get 10% off year 1.

+ The people of Italy haven’t hated something this much since the Olive Garden was founded in 1982…

It appears Jeffrey Commerce didn’t learn his lesson (see: $38B divorce settlement with Mackenzie). Bezos married his long-time girlfriend, Lauren Sánchez, in Venice over the weekend… despite the haters (read: Italians) being out in full force.

Congrats, you two crazy kids…

When you order Sofia Vergara on Temu

— #East Village Guy (#@eastvillageguy)

7:02 PM • Jun 27, 2025

+ “I don’t want to play with you anymore.” - POTUS to Canada

Our neighbors to the north f*cked around, and found out. You see, way back in the year of our lord 2022, Canada passed the Digital Services Tax. The DST is pretty simple: a 3% tax on all digital revenue generated in Canada. It applies to any big tech company with more than $800M in revenue globally and ~$15M in Canada.

As you might have guessed, American companies would be impacted the most. It’s called suffering from success. The nation whose only exports are NHL prospects, Trailer Park Boys reruns, and Tim Hortons planned to start collecting on Monday.

“And I took that personally.” - Uncle Sam

Given the recent developments (namely, US tariffs), the White House was really expecting Canada to pump the brakes on the DST. Instead, the Canadians were uncharacteristically unaccommodating.

So, on Friday, President Trump unveiled plans to retaliate with the economic equivalent of sending seven B-2 bombers equipped with bunker busters: he ended all trade talks.

By Sunday evening, however, Canada realized they done f*cked up, eh? Word came down from Ottawa that it was pausing the DST to allow for the US and Canadian trade talks to continue.

+ Meanwhile… China confirmed POTUS’ announcement Thursday that the two sides agreed to a trade deal. It’ll focus on China shipping rare earth metals to the US, and the US easing up on tech restrictions… and will presumably collapse before the ink dries.

+ The perfect ticker symbol doesn’t exi—

Tuttle Capital Management (sup, Matt) filed to launch an ETF with the ticker GRFT. And it’s exactly what you think it is. It’ll invest in “holdings disclosed by members of Congress, companies with personal or professional ties to a sitting US president, and short-term trades linked to presidential praise, speeches, or social media commentary.”

+ “I’ll f*ckin do it again.” - the price of everything

J-Poww about to hit POTUS with “told ya so.” The Fed’s preferred inflation gauge (core PCE) didn’t just rise… it came in slightly above expectations. On the bright side, investors largely didn’t give a damn. Something about low expectations for the economy being baked in. So we’ve got that going for us.

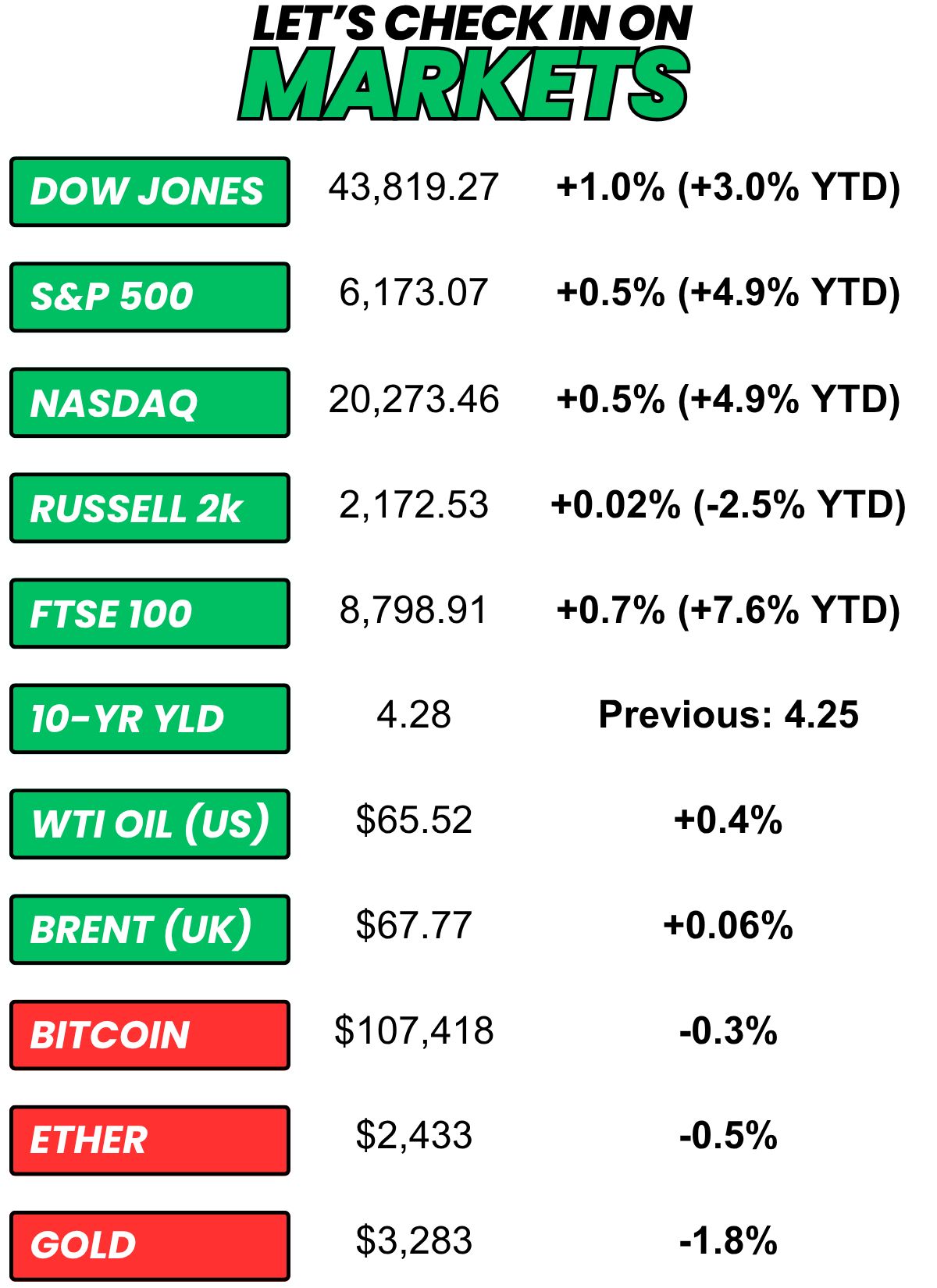

+ US stocks “hit fresh records on Friday as traders managed to look past new comments from President Donald Trump tied to U.S.-Canada tariffs.” (CNBC)

+ The 10-year yield “inched higher on Friday after the Federal Reserve’s preferred inflation gauge reflected an unexpected uptick.” (CNBC)

+ Oil “edged up slightly on Friday, recovering from a midday drop into negative territory following a report that OPEC+ was planning to hike production in August, but tumbled about 12% in the week in their biggest drop since March 2023.” (Reuters)

⏩ Today we’re keeping an eye on…

+ The quiet period post-IPO ends for Circle

Friday, I asked, “What's more embarrassing?”

37.7% of you said “Falling for a Nigerian prince scam.”

Here’s what some of you guys had to say…

Falling for a Nigerian prince scam: “This bit is over 20-years old now...”

Accidentally funding a coup in South Sudan: “Accidentally funding a coup is a very public spectacle. Fall for the Nigerian prince is potentially less embarrassing, if u don’t tell anyone.”

Getting catfished like Manti Te’o: “The Te'o story is embarassing b/c they announced getting catfished on air like it was his stats. 4 tackles and 1 pressure, not like the pressure of getting catfished, though. Hey-oh! ”

Falling for a Nigerian prince scam: “Nowadays? Has to be this. There’s so much tape out there on this scam. It’s like pyramid schemes selling herbal infused protein or timeshares, how do people STILL get suckered in for these?!?”

Here’s today’s question…

We’re going hypothetical, so here are some terms…

It’s not Club Fed, it’s a pretty sh*tty experience for her (think: Orange is the New Black)

You can’t give her any of the money

Yes, I will judge you for your answer…

Would you send your mom to jail for 1 year for $25M?

Oh, and one more thing…

What did you think about today's newsletter?

Made in America & Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.