Hey there weekday warrior,

Today, we’re getting the Pentagon’s latest stock pick (you read that right), Ferrero and Kellogg make it official, and Canada learns its tariff fate. But first...

In the July 11, 2018 edition of The Water Coolest, we met Francesco Pellegrino, a legend of Wall Street who rage quit in a blaze of glory…

Who knows if this was real… but does it really matter?

Enjoy the next 4 minutes and 23 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, today you’re tasked with picking the INAUGURAL 🏆 TWC Dumba** of the Week (The DOW). Check it out below in the EXIT INTERVIEW.

War and piece of the company

Where were you guys on telling me that there is only one operational rare Earth mine in the US… and it’s publicly traded?!

MP Materials $MP ( ▲ 0.57% ) just put on a master class in how to become too big important to the military-industrial complex to fail. Shares went parabolic on news that the Pentagon (yes, that Pentagon, not some hedge fund called Pentagon Capital Partners) was set to become its largest stakeholder.

And, I’m not gonna lie, I didn’t know that was a thing. In the words of #45, “Wow. I didn't know that, you're telling me now for the first time” that the Pentagon takes stakes in public companies…

Oh, and before you go, “sounds like Communist propaganda,” MP’s CEO made it clear, “this is not a nationalization.”

Makes sense…

The deal was a no-brainer for MP… not that it really had a choice (see: Pentagon controlling the largest nuclear arsenal in the history of the world).

But it might make even more sense for Uncle Sam. MP is currently the only show in town (and by show, I mean rare earth miner, and by town, I mean the United States of America).

America needs rare earth metals to maintain its military supremacy. The metals are used in everything from planes to submarines.

Did I mention that nearly ¾ of these types of materials come from China currently?

It might sound crazy, but there's a much easier way to pay down debt faster…

Spoiler: using a credit card.

Here’s EXACTLY how to do it…

Find a card with a “0% intro APR" period for balance transfers

Transfer your debt balance

Pay it down as much as possible during the intro period

No interest means you could pay off the debt faster.

Now it’s time to find the right card…

Some of the top credit card experts identified one of their favorites that puts interest on ice until nearly 2027 AND offers up to 5% cash back on qualifying purchases.

+ Tony the Tiger is about to start going by Anthony, wearing a gold chain, and getting a little too handsy…

It’s official. WK Kellogg $KLG ( ▲ 0.35% ) is being acquired by Italian candy maker Ferrero for $3.1B. But you already knew that because you read yesterday’s newsletter. The move will increase Ferrero’s foothold in the US, and more importantly, we might get Nutella Frosted Flakes.

+ 51st state, eh?

Canada’s tariff assignment is fresh off the printer. POTUS announced that our neighbors to the north will be hit with a 35% tariff starting August 1st. But, there will be an exemption for any goods that comply with the US-Mexico-Canada Agreement. So they’ve got that going for them, which is nice.

+ Ever been in a Robotaxi and thought to yourself, “This sure would be more enjoyable if it were more of a bigot?”

Welp, you’re in luck…

In addition to expanding its Robotaxi services in ATX this weekend, Tesla $TSLA ( ▲ 3.5% ) will add Grok integration to all rides. ICYMI, earlier this week, Grok got more racist than your drunk friend trying to do a Shane Gillis impression.

+ Your scientists were so preoccupied with whether or not they could, they didn't stop to think if they should…

Varda just raised $187M to… wait for it… manufacture drugs (and not the fun kind, either) in space. Apparently, the pharmaceuticals crystallize differently in orbit, which allows the human race to manufacture hard-to-make drugs. The money will be used for more space flights, and to figure out what drugs are good candidates to be manufactured in and around where Katy Perry and Lauren Sanchez claim to have visited via Blue Origin.

+ New high score. Last night, while you were busy at happy hour, mouth breathing virgins everywhere were watching Bitcoin breach $116k for the first time ever. What a time to be alive.

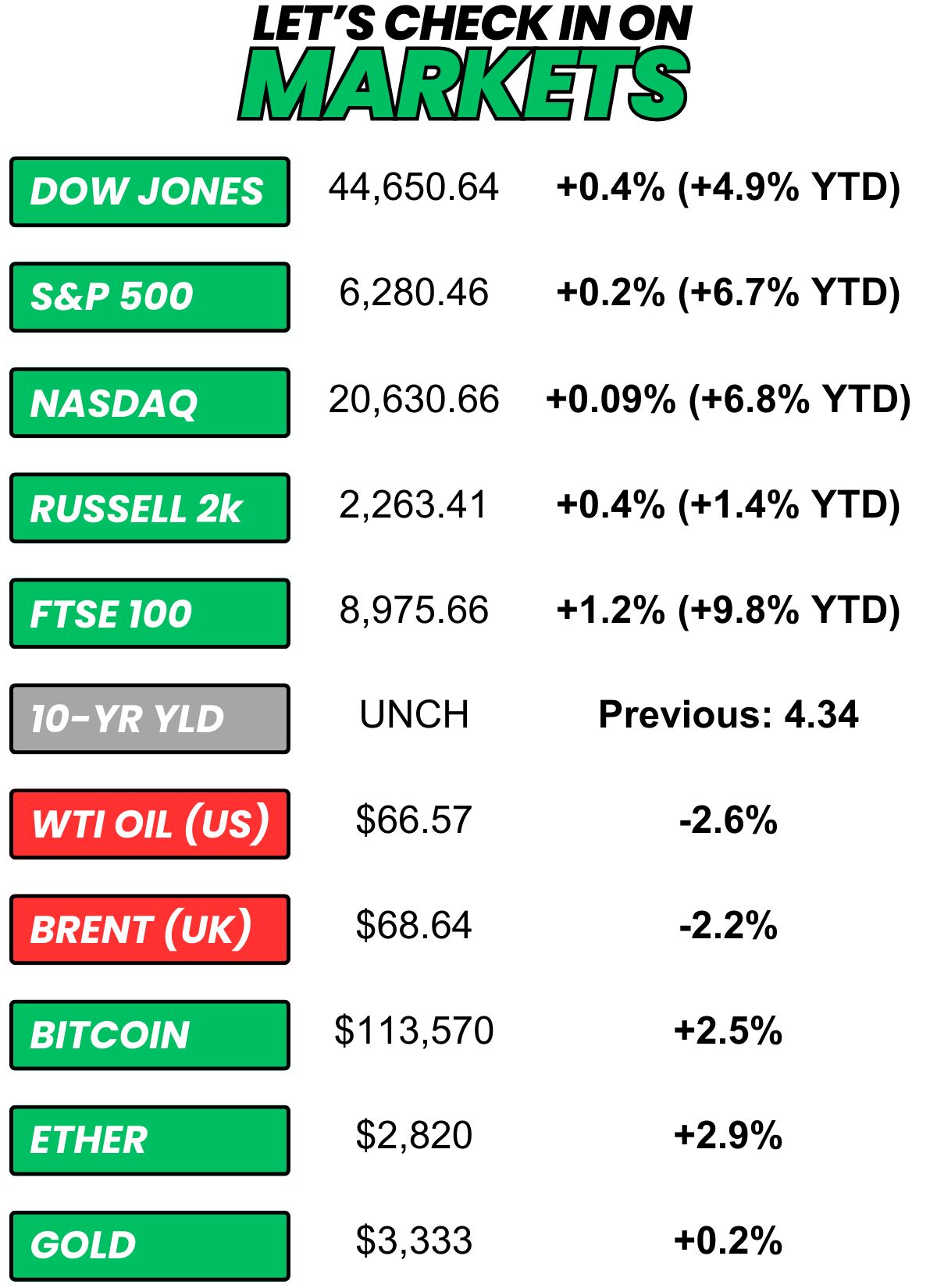

+ US stocks “rose to eke out fresh record highs on Thursday, as Nvidia (NVDA) ticked higher following a major milestone and bitcoin (BTC-USD) surged to a new record amid fresh tariff threats from President Trump.” (Yahoo! Finance)

+ The 10-year yield “was little changed on Thursday after the release of new data pointing to strength in the US economy.” (CNBC)

+ Oil “fell more than 2% on Thursday, as investors weighed the potential impact of U.S. President Donald Trump’s tariffs on global economic growth.” (Reuters)

+ Bitcoin “reached a new all‑time high against the US dollar on Thursday, climbing to over $112,000 (£82,279), surpassing its previous peak of around $111,900 seen in May 2025.” (Yahoo! Finance)

+ The “smart” money thinks there’s an 18% chance marijuana will be rescheduled to a lower schedule before 2027 (Kalshi)

⏪ Yesterday…

+ Delta Airlines reported before the bell

+ Levi’s and Vista Oil Gas reported after the bell

⏩ Today we’re keeping an eye on…

+ The US Treasury Department will release a monthly account of the surplus or deficit of the federal government

Yesterday, I asked, “You have to take one of the following jobs for the next 4 years. Which are you taking?

44.5% of you said “President of the United States.“

Here’s what some of you guys had to say…

President of the United States: “POTUS but wouldn’t I still report to Elon?”

President of the United States: “Do some shady stuff like everyone in our government and that $400k will become $400MM overnight!”

One of those Alaska crab fishermen on ‘Deadliest Catch’: “The other two jobs require me to deal with Trump or the 'Lon. I'll take my chances on the open seas.”

President of the United States: “Considering the last two have had dementia and do nothing, how hard can it be? Plus free jets and nukes!”

CEO of Twitter (report directly to Elon): “The app is already screwed up, what more could happen? Besides I don't want to be seasick or be trusted with the military.”

Here’s today’s question…

It’s Friday, which means it’s time to recognize the 🏆 TWC Dumba** of the Week (The DOW). Here are this week’s nominees…

Francesco Pellegrino for rage-quitting in a blaze of glory… (From today… ok, technically this was nearly a decade ago)

Grok for being antisemitic af (From Thursday)

The (approximately) half of Gen Z (49%) that has decided saving for the future is pointless

Goldman CEO David Solomon for forcing 20-something analysts to pledge an oath of allegiance to the bank (Wednesday)

Elon for telling Wall Street analyst Dan Ives to “Shut up” following his criticism of Elon’s new political ambitions (see: forming the America party) (Wednesday)

Zuck paying AI nerds $200M contracts (Wednesday)

Vlad Tenev for telling CNBC that "it’s not entirely relevant" that the OpenAI "equity" he's promising investors isn't actually equity (Tuesday)

Soham Parekh, who just got called out for holding 3-4 tech jobs at a time (Tuesday)

Vote (or die) below. The winner will be announced on Monday.

Who is the TWC Dumba** of the Week (The DOW)?

Stick to Twitter, Bill…

Bill Ackman (59 y/o billionaire hedge fund manager) somehow bribed his way into a professional tennis tournament today

It went about as well as you could expect:

— #Clemente (#@Chilearmy123)

1:33 AM • Jul 10, 2025

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.